what is a deferred tax provision

There are two types of deferred tax. A deferred tax liability is a listing on a.

What Is A Deferred Tax Liability Community Tax

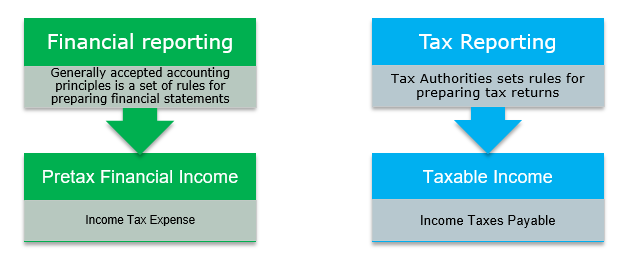

Deferred tax refers to either a positive asset or negative liability entry on a companys balance sheet regarding tax owed or overpaid due to temporary differences.

. A deferred tax asset is an asset to the Company that usually arises when either the Company has overpaid taxes or paid advance tax. A payroll tax holiday is a. The deferred income tax provision benefit equals the net deferred tax liability asset at the end of the year minus the net deferred tax liability asset at the beginning of the.

Deferred Income Tax Definition. The deferred income tax expense calculates the sum total of the temporary differences and applies the federal corporate tax rate to the resulting amount. Keep track of your.

It helps to match tax effect of certain. A deferred tax liability is a line item on a balance sheet that indicates that taxes in a certain amount have not been paid but are due in the future. You should recognize deferred tax not only because the IFRS rules say so but also because deferred tax is an important accounting measure.

A deferred tax liability DTL is a tax payment that a company has listed on its balance sheet but does not have to be paid until a future tax filing. More Deferred Tax Asset. Putting through a deferred tax charge is a way of evening out these differences so that the company doesnt overestimate its profit.

A deferred tax is recorded in the balance sheet of a company if there are chances of a reduced. A provision is created when deferred tax is charged to. Deferred income tax is a balance sheet item that can either be a liability or an asset as it is a difference resulting from the recognition of income between the.

Around the world governments are stepping in to try and limit the impact of the pandemic by providing financial support in numerous ways from direct cash payments through. The term deferred tax in essence refers to the tax which shall either be paid or has already been settled due to transient inconsistency between an organisations income statement and tax. A deferred tax liability is a line item on a balance sheet that indicates that taxes in a certain amount have not been paid but are due in the future.

The deferred income tax is a liability that the company has on its balance sheet but that is not due for payment yet. Increase the book profit by the amount of deferred tax and its provision or. A provision is created when deferred tax is charged to the profit and loss account and this provision is reduced as the timing difference reduces.

The Deferred Tax Liability or Deferred Tax Asset is derived from the comparison of Profit Loss Ac of Balance sheet and Computation of Total Income for Income Tax. There are 2 types of timing differences viz. Decrease the book profit by the amount of deferred tax if at all such an amount appears on the.

What is the purpose of a tax provision. Deferred Tax refer to tax effect in your Balance sheet due to timing differences in recognizing income. Deferred income tax expense.

Deferred Tax Double Entry Bookkeeping

What Is A Deferred Tax Liability Community Tax

What Is A Provision For Income Tax And How Do You Calculate It

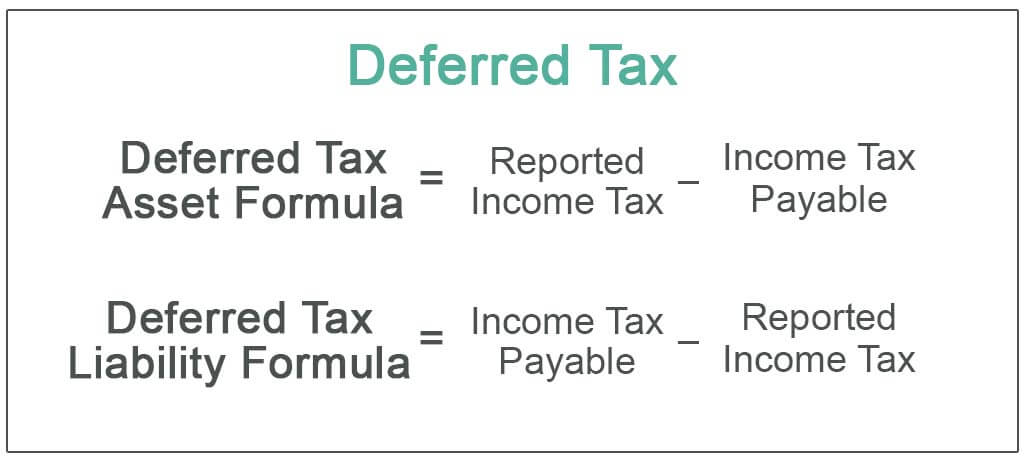

Deferred Tax Meaning Expense Examples Calculation

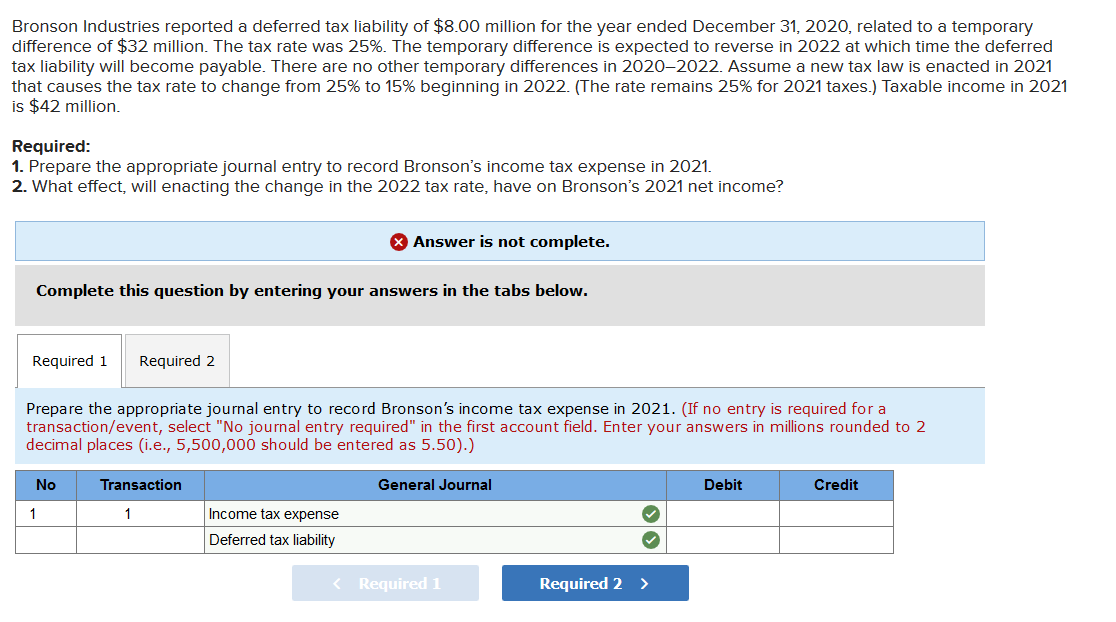

Solved Bronson Industries Reported A Deferred Tax Liability Chegg Com

Solved Discuss Whether You Think The Deferred Tax Assets And Liabilities Are Assets And Liabilities In Relation To The Definitions Contained In The Course Hero

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Deferred Tax Liabilities Meaning Example How To Calculate

Worked Example Accounting For Deferred Tax Assets The Footnotes Analyst

Define Deferred Tax Liability Or Asset Accounting Clarified

Deferred Tax Liability Or Asset How It S Created In Accounting

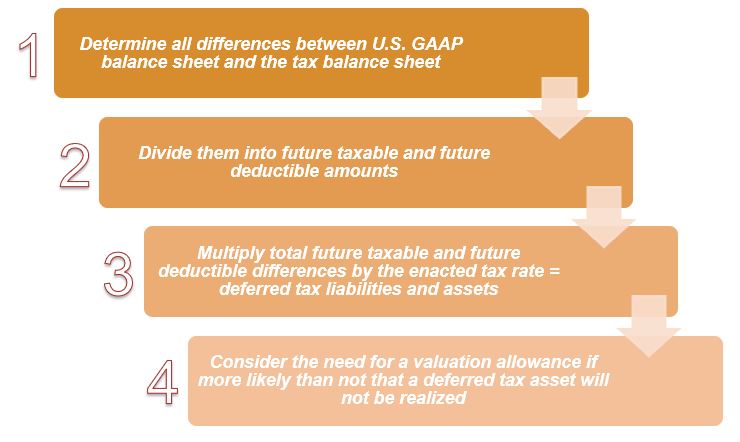

2022 Cfa Level I Exam Cfa Study Preparation

Deferred Tax Assets Deferred Tax Liability

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Deferred Income Tax Liabilities Explained With Real Life Example In A 10 K

:max_bytes(150000):strip_icc():gifv()/Deferredtaxliability_fial_rev-aa7da3f65e644dfea5b55f8ca59f54e4.png)

Deferred Tax Liability Definition How It Works With Examples